Profit Sharing Programs For Employees

Employee Bonus ProgramsHere’s a closer look at the most popular types of employee bonus plans and how to make them work for your business. Annual Individual or Team Incentive BonusesAnnual are given to individuals or teams that achieve goals set at the beginning of a performance cycle. More than two-thirds of companies in PayScale’s report use individual incentive bonuses and 23% use team incentive bonuses. Team incentive programs are best used when group effort is required to lead to a measurable result and individual efforts are difficult to quantify.To Create a Motivating Annual Incentive Bonus Program:. Set clear, consistent and measurable goals that are tied to the individual or team’s roles.

- Profit Sharing Programs For Employees Retirement

- Cash Profit Sharing Program

- Profit Sharing Plan Template

Employees should understand how their actions relate to the overall goals. Team incentives can cause problems when “moocher” employees who don’t work as hard as their teammates benefit from the group effort. To avoid this, make sure that achieving the goal you set requires the efforts of the entire team.Spot BonusesPayScale says 39% of companies use spot bonuses, which, as the name suggests, are given on the spot to reward desirable behavior. For example, you might give a spot bonus for going above and beyond, or for providing exceptional customer service.At big companies, spot bonuses can be several thousand dollars. But for small businesses, you’ll want to keep them reasonable — $25 and up will work.To Create a Motivating Spot Bonus Program:.

Create different levels of spot bonuses. You might give out very small rewards, like a $25 gift card, for being the most energetic person in the company trade show booth, on up to $500 or more for a truly above-and-beyond action. Set a budget.

Giving out spot bonuses could quickly eat up capital if you don’t set a limit. Create an annual budget for spot bonuses and don’t feel like you have to use it all if you don’t see deserving employees. Make it count. Give spot bonuses for truly exceptional behavior, not just for doing the job. Make it a surprise.

If spot bonuses become rote — employees know every week two employees get one — they lose their power to motivate. Keep employees guessing and give spot bonuses irregularly. Publicize it.

Part of the reward of a spot bonus is getting singled out in front of your teammates for your work, so make sure you award spot bonuses in front of the rest of the staff. You can also publicize it by sending out a company-wide email or making an announcement.Referral BonusesReferral bonuses are used by 39% of companies, PayScale says. They’re offered to employees who refer job candidates who get hired and complete a probationary period with your company. The theory is that birds of a feather flock together and, if someone is referred by a good employee, there’s a strong chance they’re likely to be a good worker themselves.To Create a Motivating Referral Bonus Program:. Develop a policy. Do you want to offer referral bonuses for every job, or only for certain positions? Do you want to have an ongoing referral program, or just alert employees at specific times you’re looking to hire and ask for referrals then?.

Determine how you’ll handle payouts. Some companies pay out part of the referral when the employee is hired and the rest after they complete a probationary period of three months or six months. Others give the entire bonus at the completion of the probationary period. They are standard in your industry. For instance, signing bonuses are common with IT employees. You need to attract a candidate with hard-to-find skills. You need to motivate a desirable candidate to move from another state.For small businesses on a budget, a signing bonus can enable you to land desirable employees at lower starting salaries.

Of course, signing bonuses can also backfire if candidates use them to job-hop.To prevent this, it’s a good idea to stagger your signing bonus. You might pay half of the bonus at signing, then one-quarter after the employee has worked for six months and the rest at the end of the year. Some companies also institute “clawback” provisions where employees who quit a job before a year is up must return a percentage of the signing bonus.However, don’t expect to rely on signing bonuses as your sole attraction and retention tactic. You need a comprehensive plan of employee development to keep these desirable workers motivated and loyal beyond the first year.

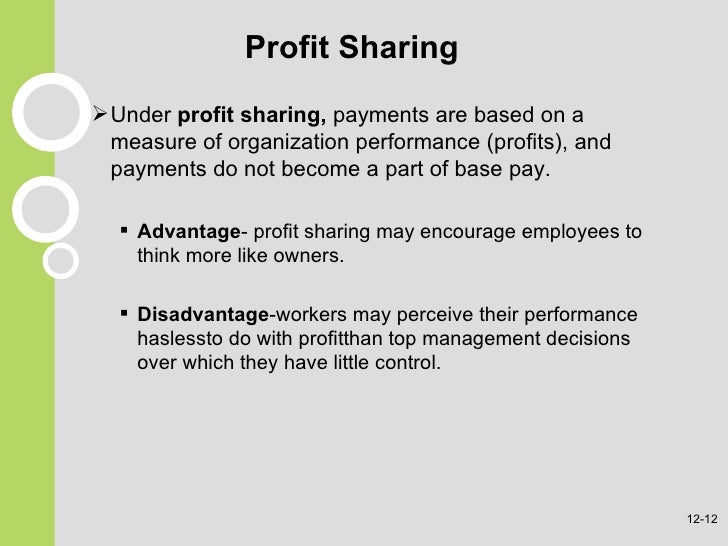

Profit-Sharing PlansProfit-sharing is more popular among small and midsized businesses than their larger counterparts — 22% of small companies in PayScale’s use it. These plans give employees a percentage of the company’s quarterly or annual profits. If you have a better-than-usual year, employees benefit.

Profit-sharing plans can be tied into your company 401(k) plan, with the profits distributed as contributions to the retirement plan or can be on a cash basis. To Create a Motivating Profit-Sharing Plan:. Profit-sharing plans tend to be very motivating because they give employees a sense of ownership in the business. Make sure employees understand how the profit-sharing plan works. Set parameters for who can participate. Typically employees must have been with a business at least one year before taking part.Profit-sharing plans, especially if tied to 401(k) plans, have specific regulatory requirements, such as keeping certain records, meeting reporting requirements and setting up a trust for the funds.

Profit Sharing Programs For Employees Retirement

Talk to your accountant or a third-party financial advisor to get assistance. Read the for more information. Bonus Structure Tips. Know how much money you have available for the bonus plan. In the case of spot or discretionary bonuses, this might be a dollar figure (you set aside $5,000 a year). In the case of longer-term bonuses, such as incentives or profit-sharing, this could be a percentage of profits or earnings.

Cash Profit Sharing Program

Base the plan on quantifiable, measurable results. Specify what the goals are, how progress toward goals will be measured, and how often. Consider setting “tiered” goals so that employees can reach different bonus levels by achieving more difficult goals. For example, a worker might get $X amount for reaching the minimum goal, but $XX for reaching the maximum.

Put your bonus plan in writing. Make sure employees understand what they have to do to get the bonus. Review the plan with the entire staff as well as with individuals (in the case of team or individual incentive bonuses).

For long-term bonuses, setting milestones along the way and reviewing progress toward the end goal quarterly can help keep employees focused. You might even want to give small bonuses at these checkpoints.Image: Shutterstock2019-05-06 Editor's Picks. I find it interesting that the incentives mentioned as examples seem to be all monetary. While cash is a decent motivator it carries with it the potential to be forgotten once it is put in the wallet.

Some call it the ‘Beer and Toilet paper’ effect of cash and gift cards. The cash used becomes more like regular pay (subject to taxes as well) and forgotten once it is used.A well thought out merchandise award will offer far more value for the same dollars. Even a small gift will be remembered often.

A business card holder? I have one that was a gift and that carries a brand name and I remember the circumstances of receiving it as a token of thanks for a job well done – 10 years later! At IncentiveAmerica, our Spot Awards program allows managers to reward employees “on the spot” or through nominations which are approved by a nominations committee. The employees not only receive the award points online which can be redeemed for brand name merchandise in a catalog, but they also receive a nice personalized note (online) from the manager, thanking them for going above & beyond.

The feedback we have received is that the employees appreciate both the gift and the note, as they both indicate that their extra effort is recognized and valued by the organization.

Profit Sharing Plan Template

Special to the RegisterEmployees at Kwik Trip Inc. Can receive a handy benefit around the holidays: roughly an extra month’s pay. Harry potter part 8 full movie in hindi download 720p. The company shares 40% of the year’s profits with its employees.That can measure between 8.5% and 13% of an employee’s yearly pay.“That is huge at the end of the business year,” Kwik Trip regional leader Dave Neimi said.Kwik Trip, based in La Crosse, Wisconsin, currently has 96 locations in Iowa between its Kwik Star convenience stores and Tobacco Outlet Plus stores.It is one of the Register’s Top Workplaces for the seventh year in a row.Along with the profit sharing, Neimi said employees start with competitive pay (more than $12.50 an hour) and get a week’s worth of vacation after 90 days. Employees with 20 years get a full-month paid sabbatical along with regular vacation days.The company’s weekly newsletter highlights stories of employees going above and beyond for customers.“When they do stuff like that, we celebrate it,” Niemi said. Kwik TripLocations: Headquartered in La Crosse, Wisconsin, with 96 Iowa locationsFounded: 1965Ownership: PrivateIowa employees: 2,300Top executive: Don Zietlow, owner and CEO.